The QQQ Hype Train: What the big money is doing and why you should probably ignore it

So a mid-sized wealth management firm you’ve never heard of just plopped down nearly $5 million on a Big Tech ETF. The news wires dutifully reported it, with one outlet headlining it DKM Loads Up on QQQ With 7,900 Shares Worth $4.8 Million. Analysts nodded sagely, and the great, grinding machine of financial commentary churned out another take.

And my first thought was: Who gives a damn?

Seriously. DKM Wealth Management, a firm with a respectable, if not staggering, $124 million in assets, bought 7,935 shares of the Invesco QQQ Trust. This is being treated as some kind of strategic maneuver worth analyzing. Let’s be brutally honest about what this is. This isn't a bold play. It’s the financial equivalent of a suburban dad buying a Toyota Camry. It’s safe, it’s predictable, and it signals absolutely nothing other than a desire not to rock the boat.

They didn’t unearth a hidden gem in the small-cap market. They didn’t short a bloated dinosaur they see teetering on the edge of collapse. They bought the NASDAQ-100. They bought Apple, Microsoft, Amazon, and the whole gang. This is just lazy investing. No, ‘lazy’ doesn’t cover it—this is terrified investing. It's the kind of move you make when your entire strategy is to hug the index so tightly that no one can ever blame you for having an original thought.

The Safest 'Brave' Move in Finance

Let’s break down the psychology here. When a firm like DKM makes the QQQ its third-largest holding, representing nearly 4% of its portfolio, it’s broadcasting one thing: "We have no idea what’s going to happen, so we’re just going to bet on the biggest kids on the playground to keep winning." The Motley Fool analysis called it gaining "balanced exposure" while "mitigating risk." That’s a beautiful piece of corporate-speak. My translation? It’s a way to capture the upside of tech’s relentless, bubble-like expansion without having to do the actual, brain-hurting work of figuring out which companies are solid and which are just running on hype and cheap capital.

It's like going to a restaurant with a thousand-page menu and, instead of choosing a dish, you just bet the chef won't burn the building down before you finish your water. You're not betting on a specific outcome; you're betting on the continuation of the system itself. And right now, the system is Big Tech.

Imagine the meeting where this decision was made. I see a polished conference table, lukewarm coffee in ceramic mugs, and a junior analyst pointing to a chart showing QQQ’s 23.84% year-to-date return. "It keeps going up," he says, with the profound insight of a child discovering gravity. A senior partner, terrified of underperforming the benchmark by a single basis point, nods slowly and says, "Do it." And that’s it. That’s the deep, strategic thinking that moves millions of dollars in today’s market. It’s a collective shrug, a surrender to the algorithm. What real conviction is being shown here?

All Aboard the Winter Rally Gravy Train

Then you get the so-called experts chiming in, adding a layer of sophisticated justification to this deeply unsophisticated move. You see articles titled Use Seasonal Returns To Find Better Trades, From GLD To QQQ, pointing to the "winter tech rally," a seasonal pattern where QQQ historically performs well from November through February. Groundbreaking stuff. Telling people that tech stocks tend to do well at the end of the year is like revealing that retail stores see an uptick in sales around Christmas.

Offcourse, this has become a self-fulfilling prophecy. Enough people believe in the winter rally, so they pile in around November, which… creates the winter rally. It’s a feedback loop disguised as a market anomaly. DKM isn’t timing the market with genius precision; they’re just getting on the same crowded escalator as everyone else, hoping it goes up. They're all just chasing the same dragon, and eventually...

This is what passes for "active" investing now. The fact sheet even notes that QQQ, with its higher expense ratio, is for "active traders," while its cheaper cousin, QQQM, is for buy-and-hold types. Give me a break. Actively trading what? An index? You're not outsmarting anyone. You're just gambling on the collective mood swings of the herd, paying a premium for the privilege of doing so with high liquidity.

It’s a symptom of a market that has lost its soul. We’ve replaced fundamental analysis with pattern recognition and stock picking with basket buying. Why bother digging into a company’s balance sheet when you can just buy the entire tech sector with a single click? It’s easier, it’s safer, and your boss won’t fire you for it. But what does it say about the state of American capitalism when the path of least resistance is to just throw your money at the same 100 companies that already dominate our lives? Then again, maybe I'm the crazy one for expecting anything more.

The Illusion of Choice

Here’s the part that really gets under my skin. This move by DKM, and thousands of others like it, is celebrated as a savvy way to invest in innovation. But it’s the opposite. It’s an investment in monopoly. By funneling billions upon billions into index-tracking ETFs like QQQ, the market is cementing the dominance of the giants. Money flows to the biggest companies not because they are necessarily the best or most innovative, but simply because they are the biggest. It’s a system that starves emerging competitors of capital and ensures the throne is never seriously challenged.

This isn’t diversification; it’s concentration masquerading as diversification. You think you’re buying 100 different companies, but you’re really just making a massively leveraged bet on the fortunes of a handful of behemoths that make up a huge slice of the index.

So, should you care that DKM bought $4.76 million worth of QQQ? No. You absolutely should not. It’s a footnote in a much larger, more troubling story. The real question isn’t what DKM is doing. The real question is, what happens to a market when everyone is making the exact same "safe" bet? When every wealth manager, every 401(k), every retail trader is just buying the index? How big does the everything bubble get before something finally, inevitably, pops?

Just Another Tuesday on the Titanic

At the end of the day, this whole story is a non-event. A mid-tier firm made a mid-tier move based on grade-school-level market analysis. It’s the kind of thing that happens a thousand times a day in offices across the country. But it’s a perfect, depressing snapshot of a market that has traded courage for consensus. We're all just buying the same ticket on the same giant, luxurious ship, telling ourselves it’s unsinkable because its market cap is so high. And nobody seems interested in checking for icebergs.

Related Articles

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

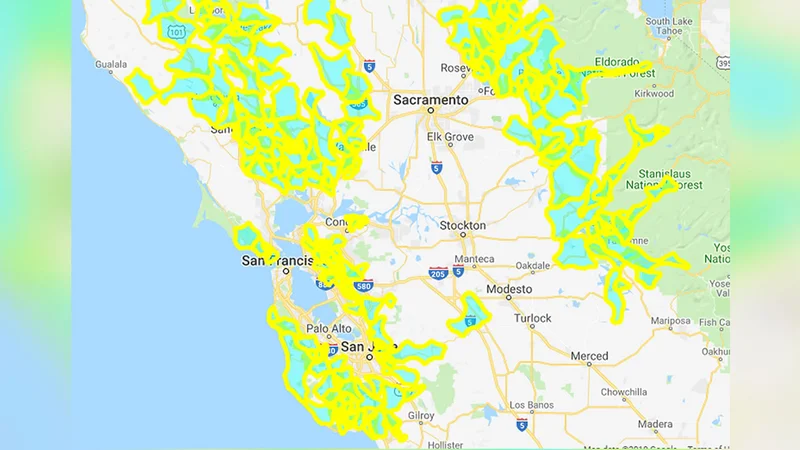

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Funko's Future: Sales Dip vs. Pop Culture Domination – What Reddit is Saying

Funko's Not Dying, It's Evolving: Why the Pop Culture King is Poised for a Comeback Okay, let's be r...

The 'Mad Money' Phenomenon: What Our Search for Cramer & Keaton Reveals About Us

Jim Cramer Just Dismissed the Future of Work and Flight. Here's Why He's Missing the Bigger Picture....

Brad Gerstner's Vision for the Next AI Titan: Why AMD's 'Bet the Farm' Move Could Change Everything

Every so often, a piece of news hits my desk that feels less like an update and more like a tectonic...

Hims Stock Surges 39%: A Data-Driven Look at the Surge

The ticker for Hims & Hers Health (HIMS) has been on a tear. A 39% surge in a single month is the ki...