The 'Mad Money' Phenomenon: What Our Search for Cramer & Keaton Reveals About Us

Jim Cramer Just Dismissed the Future of Work and Flight. Here's Why He's Missing the Bigger Picture.

You can almost hear it through the screen. The cacophony of sound effects—the bull horns, the cash register cha-chings—and the whirlwind energy of a man in rolled-up shirtsleeves, shouting stock picks like a carnival barker. This is the stage for Mad Money with Jim Cramer, a show built on the frantic, minute-by-minute pulse of the market. And on his October 10th episode, during the signature "Lightning Round," host Jim Cramer did exactly what he’s famous for: He delivered rapid-fire, gut-check verdicts on the hopes and dreams of everyday investors.

A caller asked about UiPath. Cramer’s take, as detailed in CNBC's Cramer's Lightning Round: 'I can't recommend' UiPath - CNBC, was simple: "It just had such a big move, I can’t recommend it. It just, just soared. It’s not for me."

Another caller, another dream. Archer Aviation. The verdict? "No, we’re going to let that come down. We’re in a kind of speculative tsunami right now."

And just like that, in under a minute, two of the most profound technological shifts of our generation—the automation of work and the dawn of urban air mobility—were reduced to red or green arrows on a stock chart. Cramer, the mad money host, was playing his game, and he was playing it by his rules. But his rules, the ones governed by quarterly earnings and short-term volatility, are the wrong lens for viewing a true revolution. Looking at these companies through the pinhole of a stock ticker is like trying to appreciate the Sistine Chapel by analyzing the chemical composition of a single fleck of paint. You see the data, but you miss the masterpiece entirely.

The Invisible Revolution Happening on Our Desktops

Let’s talk about UiPath. When Cramer says it "just soared," he’s looking at a line on a graph. I look at it and see the physical manifestation of a paradigm shift that’s been brewing for years. UiPath is a leader in something called Robotic Process Automation, or RPA. Now, that sounds incredibly complex, so let's use a simpler term. Think of it as giving every employee a digital assistant—an invisible, tireless teammate who can read emails, fill out forms, move files, and update spreadsheets at the speed of light.

When I first saw a demo of this technology in action years ago, I honestly just sat back in my chair, speechless. It wasn't just about efficiency; it was about humanity. It was about liberating brilliant human minds from the soul-crushing drudgery of repetitive digital paperwork. This is the kind of breakthrough that reminds me why I got into this field in the first place. We're not just building better software; we're building better work.

Cramer's analysis is rooted in the "what is" of today's market. But the real question, the one that defines the next century, is "what if?" What if every scientist, every doctor, every artist, and every small business owner could offload 30% of their administrative burden to a digital partner? What new cures could be discovered, what new masterpieces created, what new businesses launched from that reclaimed ocean of time and cognitive energy? Dismissing this as a stock that "soared" is missing the point. It’s like dismissing the invention of the printing press because the price of paper went up. The value isn’t in the paper; it's in the renaissance it's about to unleash.

Redefining the Skyline, and Our Lives With It

Then there’s Archer Aviation, dismissed as part of a "speculative tsunami." And yes, from a purely financial perspective, creating a new form of transportation is speculative. So was connecting the world with undersea cables. So was building a network of satellites to beam information from the heavens. The greatest leaps forward always look like speculation from the ground floor.

Archer isn't just building "flying cars." That’s a sci-fi caricature. They are building a system to fundamentally reshape the physical geography of our lives. Imagine a world where the 90-minute commute, a soul-sucking daily ritual for millions, simply ceases to exist. Imagine being able to live in a smaller, more affordable town surrounded by nature and still being able to pop into the city for a meeting in 15 minutes—this is the promise, a future where our cities are less congested, our air is cleaner, and our time is returned to us.

This isn't about luxury; it's about logistics. It’s about creating a new layer of transit that could connect disparate parts of a region, making it possible for hospitals to transport organs faster, for emergency services to bypass gridlock, and for families to live where they want, not just where the jobs are. Are there hurdles? Of course. We need robust regulation, fail-safe autonomous systems, and a plan for equitable access so this doesn't just become a toy for the 1%. That ethical responsibility is enormous. But to label the entire endeavor a "tsunami" of speculation is to lack the imagination to see the shore on the other side. This isn't a bubble; it's the birth of the three-dimensional city.

Seeing the Forest, Not Just the Ticker

In the end, the Mad Money show operates on one timeline: now. It’s a game of immediate gains and losses, of bulls and bears fighting over percentage points. And in that arena, Jim Cramer is a master.

But progress—real, world-altering progress—operates on another timeline altogether. It’s a slow, deliberate, and often messy process that doesn't fit neatly into a "Lightning Round" segment. The work of companies like UiPath and Archer isn’t about hitting a target price by next quarter. It’s about methodically building the infrastructure for the next century.

To focus on the short-term volatility of their stock is to be a historian standing on the shores of Kitty Hawk in 1903, watching the Wright Flyer sputter for 12 seconds, and concluding that the future of travel is, and will always be, the railroad. The visionaries aren't the ones watching the ticker; they're the ones watching the sky. And right now, the sky is about to change forever.

Related Articles

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...

SOUN Stock Plunge: Revenue Surge vs. Market Skepticism

Alright, let's dissect this SoundHound AI (SOUN) situation. The headline screams "strong revenue sur...

Funko's Future: Sales Dip vs. Pop Culture Domination – What Reddit is Saying

Funko's Not Dying, It's Evolving: Why the Pop Culture King is Poised for a Comeback Okay, let's be r...

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

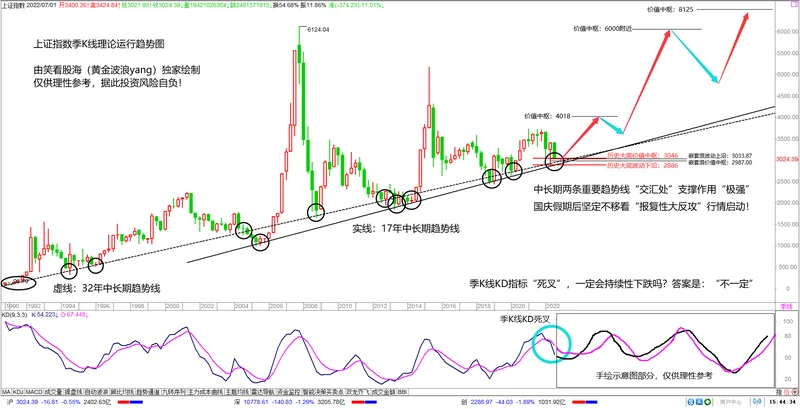

China's SSE Index Upgrade: Why This Signals a New Era for Global Tech & Finance

I spend most of my days thinking about the future. I look at breakthroughs in quantum computing, AI,...

Robinhood's Next Chapter: Decoding the 2025 Vision and What It Means for the Future of Investing

It’s easy to get lost in the numbers, and with Robinhood in 2025, the numbers are absolutely stagger...