Brad Gerstner's Vision for the Next AI Titan: Why AMD's 'Bet the Farm' Move Could Change Everything

Every so often, a piece of news hits my desk that feels less like an update and more like a tectonic plate shifting beneath the entire industry. This is one of those times. When I first read the details of the deal between AMD and OpenAI, I honestly just sat back in my chair, speechless. We’re not just talking about a big order for microchips here. We’re talking about a strategic alliance so audacious, so colossal in scope, that it has the potential to redraw the map of the entire AI revolution.

The numbers themselves are staggering. OpenAI has reportedly committed to purchasing up to six gigawatts of power worth of AMD’s next-generation Instinct MI450X GPUs. In return, AMD has granted OpenAI warrants for up to 160 million shares—nearly 10% of the company—contingent on that purchase. Let me offer a clarifying self-correction here: a warrant isn’t just a discount coupon. It’s a right to buy stock at a fixed price, meaning if AMD’s stock soars because of this deal, OpenAI benefits massively. In simpler terms, AMD isn’t just selling chips to a customer; they’re making OpenAI a co-pilot, strapping them into the cockpit and handing them a share of the controls for a moonshot mission.

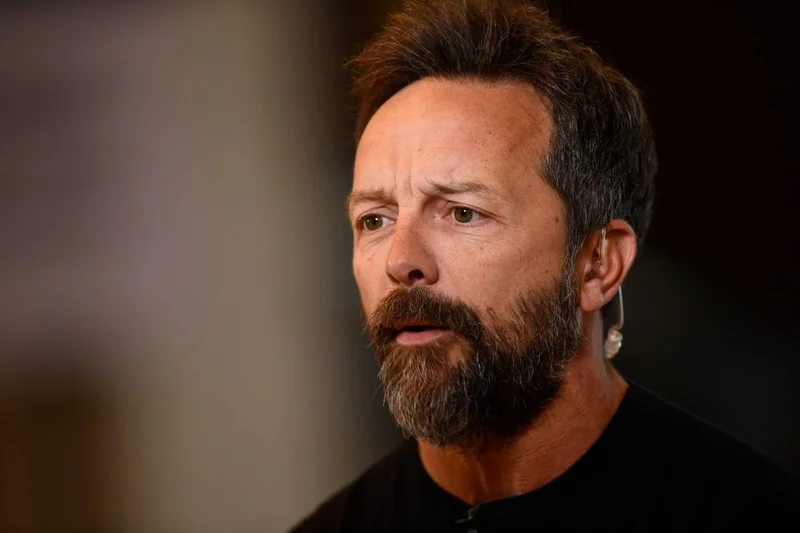

Brad Gerstner of Altimeter Capital called it a "bet-the-farm" moment for AMD’s CEO, Lisa Su. And while that phrase implies a desperate gamble, I see something else. I see a visionary leader looking at a board dominated by a single king and deciding not to play by the established rules, but to flip the entire table over.

The Fortress and the Catapult

To understand the gravity of this move, you have to understand the world it’s happening in. For the last few years, the AI hardware landscape has been less of a competitive market and more of a kingdom ruled by a single, undisputed monarch: Nvidia.

Two and a half years ago, AMD and Nvidia were peers, both hovering around $25 billion in revenue. Today, Nvidia is projected to hit an astronomical $210 billion, while AMD sits at $33 billion. That gap isn't just a market trend; it's a chasm. Nvidia has captured nearly 100% of the incremental AI data center revenue since 2022. How? It wasn’t just about having a slightly better chip. As Gerstner correctly pointed out in Altimeter Capital CEO Brad Gerstner Breaks Down AMD-OpenAI GPU Bet, Says Lisa Su Is Betting The Farm To Catch Up To Rival Nvidia - Sahm, Nvidia built an ecosystem—a fortress defended not just by silicon walls, but by the deep, treacherous moat of its CUDA software platform. The unit of compute is no longer the chip; it’s the entire data center, and Nvidia has been the sole architect.

This is the kind of technological dominance that we haven't seen since the early days of proprietary operating systems. It’s powerful, it’s effective, but it’s also dangerous for innovation. When one company holds all the keys, they also get to decide which doors get opened and which remain locked forever. What brilliant ideas have been stifled because they didn't align with a single company's roadmap? What new architectures have gone unexplored because the tools were controlled by a gatekeeper?

This AMD-OpenAI deal is the strategic equivalent of building a massive, state-of-the-art catapult right outside that fortress's walls. It’s not just about flinging a few stones; it’s a fundamental challenge to the existing power structure. OpenAI, the leading wielder of AI, is now financially and technologically tethered to the success of Nvidia’s chief rival. This changes everything.

Forging a New Path in Silicon and Code

This isn't a simple transaction; it's a co-evolutionary pact. AMD’s previous-generation chip, the MI350, was, by most accounts, "just not competitive." The company knew it couldn't just build a slightly better piece of hardware. It had to create something so compelling that the world’s most important AI company would be willing to stake its future on it. And OpenAI, facing an ever-growing need for compute and the supply chain risk of relying on a single vendor, needed a viable second source.

This deal is the result. It’s a declaration from OpenAI that they believe the upcoming MI450X isn't just an alternative, but a true contender. The sheer scale of the potential revenue—analysts are throwing around figures from $100 billion to $150 billion—is almost hard to comprehend, but it’s the structure of the deal that truly excites me. The warrant system creates a symbiotic relationship where both companies are desperately invested in the other’s success—it’s a partnership forged in the fires of mutual necessity and ambition, and you can almost feel the heat from the immense energy and capital and human ingenuity being poured into this single venture.

This is the kind of breakthrough that reminds me why I got into this field in the first place. It’s a testament to the fact that no matter how entrenched a monopoly seems, a bold enough vision, backed by courageous leadership, can still carve out a new future.

Of course, with this much power comes immense responsibility. We are talking about concentrating a nation-state's worth of computational power into the hands of a few. The ethical guardrails we build around these systems become more critical than ever. But the first step toward a responsible future is ensuring that future isn't dictated by a single corporate entity. Competition breeds accountability. It forces transparency. It fuels the very innovation that might solve the problems it creates. Imagine what we can build when the architects of our digital world are forced to compete not just on performance, but on vision, openness, and trust.

The Monolith Is Starting to Crack

Let’s be clear. This isn’t just about AMD selling chips. This is the sound of a new starting gun being fired in the race for the future of intelligence. For years, we’ve watched one company run the race virtually alone, setting a pace that, while impressive, was ultimately its own. Now, we have a real challenger, backed by the most significant player in the AI application space. This is the moment the AI hardware monopoly officially ends. It’s the first, deep, undeniable crack in the monolith. And through that crack, a whole new world of possibility is about to pour in.

Related Articles

That VTI 'What If' Article: Why It's Mostly Garbage

So, I pulled up my portfolio this morning. September 4, 2025. Ten years to the day since I dropped a...

SOUN Stock Plunge: Revenue Surge vs. Market Skepticism

Alright, let's dissect this SoundHound AI (SOUN) situation. The headline screams "strong revenue sur...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

Comerica Bank: Locations, Phone Numbers, and Why You Can't Find a Human – Give Me a Break...

Generated Title: Comerica: Still a Bank, Or Just a Search Engine Optimization Nightmare? Okay, let's...

Nasdaq Composite: what the 'rise' really means

Wall Street's Perpetual Motion Machine: Celebrating Barely Avoiding Disaster Alright, so the governm...

The 'Mad Money' Phenomenon: What Our Search for Cramer & Keaton Reveals About Us

Jim Cramer Just Dismissed the Future of Work and Flight. Here's Why He's Missing the Bigger Picture....