The VIX Name is a Complete Mess: What the Streaming Service Is vs. That Stock Market Thing

So, the market’s "fear gauge" finally decided to show a pulse. Give me a break. On Friday, the VIX shot up to 21.31, a spike of nearly five points, because the former president decided to tweet-threaten his way back into the headlines with tariffs. And now, I’m reading whispers in reports like VIX Spikes Above 20 After Trump's Tariff Threats - Barron's that this "could finally wake Wall Street."

Wake it up? To what, exactly? The fact that a volatile political figure can tank the market with a few sentences? Is this new information? It’s like being shocked that your cat knocked a glass off the table. It’s not a bug; it’s a feature of the system we’re all trapped in. For months, since the beginning of August, the VIX has been snoozing below 20, letting everyone pretend the world was a calm, predictable place. It was a lie, a comfortable, money-making lie, and we all knew it.

This ain't some black swan event. It's the same old swan, in the same old pond, doing the exact same thing it did last time.

The Illusion of Calm Is Officially Over

Let’s be real about what the VIX index actually is. The finance bros call it the "fear gauge." I call it the "Rich Guy Panic Meter." It essentially measures how much traders are willing to pay for insurance against a market drop in the S&P 500. When it’s low, everyone’s fat and happy, convinced the line will only go up. When it spikes, they’re scrambling for life rafts.

For more than two months, that meter was sitting at a level that suggested a Zen garden. Everyone just conveniently forgot that back in April, this same tariff nonsense sent the VIX screaming past 60. We touched the hot stove, got a third-degree burn, and then spent the summer pretending stoves aren't hot. The sheer, willful amnesia is staggering.

What did we think was going to happen? That the fundamental instabilities just… went away? This spike to 21 isn't a sign of a new crisis. It's a sign that reality, for a fleeting moment, has punctured the bubble of delusion. This is the market equivalent of a hangover. It’s painful, it’s ugly, and it was entirely self-inflicted. The only question is how quickly everyone will reach for the next drink.

The whole thing is so predictable it’s boring. Offcourse, a threat of economic warfare is going to rattle things. But why does it take an actual event for anyone to notice? Are the people managing trillions of dollars really just reacting, with no foresight whatsoever? Or is the game simply to ride the wave of idiocy for as long as possible and just hope you’re the first one to cash out when it breaks?

'Waking Up' Wall Street? Don't Make Me Laugh

This brings me to the line that really set me off: the idea that this jolt "could finally wake Wall Street."

This is a bad idea. No, 'bad' doesn't cover it—this is a fundamentally dishonest framing of the situation. Wall Street isn't "asleep." It's high. It's addicted to the stimulus of low volatility and predictable gains. It knows the risks are there, lurking under the surface, but acknowledging them would mean turning off the music. And nobody wants the party to end.

This VIX spike isn't an alarm clock; it's the sound of a distant siren that everyone’s going to ignore until the ambulance is in their driveway. They’ll see the new VIX price, adjust some algorithms, and then go right back to the same risky behavior that created the fragility in the first place. The system doesn’t reward caution; it rewards brazen, leveraged risk-taking. Why would a single-day spike change a formula that has made so many people so obscenely wealthy?

It's just like a gambler who loses a huge pot and dramatically swears off cards forever. You know, and he knows, that he'll be back at the table an hour later, looking for a loan. The institutional memory is nonexistent. They'll paper over this with some analyst reports about "market resilience" and "buying opportunities," and the financial news channels will bring on the same empty suits to draw lines on a VIX chart and say nothing of substance, because the alternative is just…

Honestly, I’m starting to think half the traders out there are confusing the stock VIX with the VIX streaming app on their phones. They’re probably more worried about missing a Real Madrid game in the Champions League than they are about systemic risk. At least the outcome of a soccer match is unpredictable in an entertaining way. This is just depressingly repetitive.

The Market Has a Memory of Five Minutes

So, are we awake now? No. We’re not. This isn’t an awakening; it’s a twitch in the middle of a coma. A momentary gasp before the patient settles back into blissful unconsciousness. Nothing will be learned. No fundamental changes will be made. The VIX will settle back down, and the narrative will shift to "recovery" and "strength." And we'll do this all over again in a few months.

Maybe I'm the crazy one for even expecting anything different. Maybe the point isn't to build a stable system but to master the art of surfing the chaos. But don't you dare call this an awakening. It's just the sound of the snooze button.

Related Articles

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

The 'Mad Money' Phenomenon: What Our Search for Cramer & Keaton Reveals About Us

Jim Cramer Just Dismissed the Future of Work and Flight. Here's Why He's Missing the Bigger Picture....

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

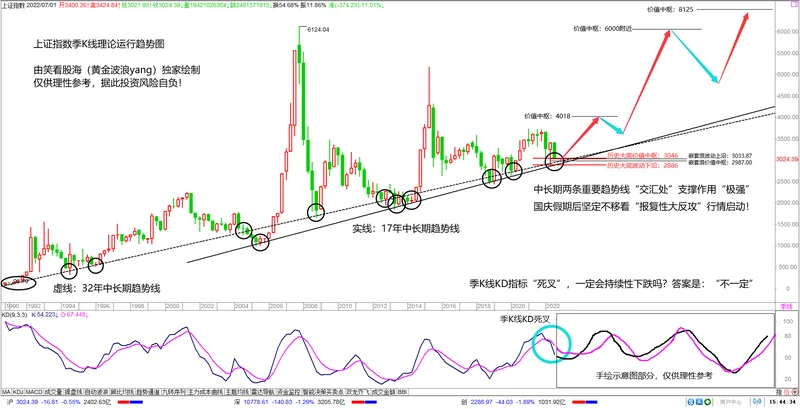

China's SSE Index Upgrade: Why This Signals a New Era for Global Tech & Finance

I spend most of my days thinking about the future. I look at breakthroughs in quantum computing, AI,...

DWP Christmas Bonus 2025: Eligibility and Payment Shifts

The DWP's Christmas Bonus: A Tiny Spark of Hope in a Winter of Need Okay, folks, let's talk about so...

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...