RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in valuation. Over the past twelve months, the company’s stock has traveled from sub-$1 obscurity to a peak of around $40, inflating its market capitalization to nearly $13 billion. This ascent, a staggering 4,000% gain, has been fueled by a potent combination of technical milestones and a few key contract announcements.

Yet, a clinical examination of the numbers reveals a profound disconnect. This is a company on track to generate perhaps $8 million in revenue for the entire year. The juxtaposition of a thirteen-billion-dollar valuation against an eight-million-dollar revenue stream is, to put it mildly, an outlier. It demands we look past the ticker tape and ask a simple question: What, precisely, are investors buying?

The Anatomy of the Dislocation

The primary catalysts for Rigetti’s explosive rally in September and October were two announcements. The first was a $5.8 million, three-year contract with the U.S. Air Force Research Laboratory. The second, and more impactful, was the disclosure of $5.7 million in purchase orders for two of its Novera quantum computers. These are tangible, positive developments for an early-stage company. They signal credibility and nascent commercial interest.

But let’s analyze the market’s reaction. The news of the two Novera orders, a deal worth $5.7 million in future revenue, added approximately $1.56 billion to Rigetti’s market capitalization in the immediate aftermath. This is not a typo. The market assigned $273 of new value for every single dollar of new business announced. This isn't a valuation based on fundamentals; it's a reaction driven entirely by narrative. The market isn't pricing the sale of two quantum computers; it's pricing the implication that these are the first two of thousands, a dynamic that has led to Rigetti’s $13 Billion Quantum Leap – Stock Hits Record High on Big Deals, But Is the Hype Real?.

This dynamic is like valuing a single lottery ticket not based on its $2 cost, but on the full $500 million jackpot, completely ignoring the astronomical odds against winning. The market has priced in the win, not the chance. It has extrapolated a few data points into a curve that shoots vertically into the stratosphere. At what point does a forward-looking valuation become untethered from any plausible, risk-adjusted reality? Are investors buying a stake in a business, or are they simply buying a token representing the abstract idea of quantum computing's future?

This phenomenon isn’t unique to Rigetti. Its peers, IonQ (IONQ) and D-Wave Quantum (QBTS), have seen similarly spectacular runs, creating multi-billion dollar valuations on the back of minimal revenues. The entire sector is behaving like a single, correlated asset class driven by sentiment, with some touting the potential of 3 Quantum Computing Stocks That Could Make a Millionaire. It’s a gold rush for a technology that, by the admission of its own CEO, is still four to five years away from creating real commercial value. Investors are paying 2030 prices for a 2025 reality, a discrepancy that carries immense risk.

A Balance Sheet at War with an Income Statement

If you were to only look at Rigetti’s balance sheet, you’d see a fortress. The company ended the second quarter with $571.6 million in cash and equivalents (and, critically, zero debt). This financial strength is the result of a shrewd, if dilutive, $350 million at-the-market stock offering. This war chest gives Rigetti a multi-year runway to fund its heavy R&D spending, effectively taking near-term operational risk off the table. It can afford to pursue its technical roadmap without worrying about its next capital raise.

But then you look at the income statement, and the picture changes entirely. Quarterly revenue was just $1.8 million, down 42% year-over-year. The net loss for the quarter was $39.7 million. I've spent my career looking at financial statements, and the sheer disconnect between Rigetti’s income statement and its balance sheet is something to behold. The former speaks of a small R&D outfit; the latter, a war chest built for a decade-long siege.

This internal conflict is mirrored in Wall Street’s own analysis. Of the analysts covering the stock, nearly all rate it a "Buy" or "Strong Buy." They are believers in the long-term story. Yet, their actions betray a deep skepticism about the current price. The consensus 12-month price target sits around $20. To be more exact, some targets are as low as $18, while the highest on the street from B. Riley is $35. This is a bizarre situation where the professionals are simultaneously telling clients "this is a great company" and "the stock is worth half of its current price."

This dissonance is further complicated by insider activity. While major institutions like Vanguard have been increasing their positions, company executives and directors have been consistent sellers, unloading millions of dollars worth of stock into the rally. When the people with the most information are cashing out, it’s a data point that cannot be ignored. It suggests that, at a minimum, they view the current valuation as a favorable opportunity to diversify.

A Valuation in Search of a Business

My analysis leads to a stark conclusion. The current RGTI stock price is not a reflection of the company's present value or even a rational assessment of its future prospects. It is a speculative instrument trading on a powerful, compelling, and entirely unproven narrative. The market has priced in not just success, but a flawless, monopolistic, world-conquering victory on par with the early days of NVIDIA (NVDA). It has done so years before the first meaningful commercial battles have even been fought.

The primary risk here isn't that Rigetti will fail. The company is well-funded and is making legitimate technological progress. The risk is that Rigetti merely succeeds on a normal, difficult, and competitive timeline for a deep-tech company. A future where Rigetti becomes a healthy, growing business with hundreds of millions in revenue by the end of the decade would be a tremendous success for the company—and a potential catastrophe for anyone buying the stock at a $13 billion valuation today. The current price leaves no margin for error, competition, or the simple friction of turning groundbreaking science into a profitable enterprise.

Related Articles

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

DWP Christmas Bonus 2025: Eligibility and Payment Shifts

The DWP's Christmas Bonus: A Tiny Spark of Hope in a Winter of Need Okay, folks, let's talk about so...

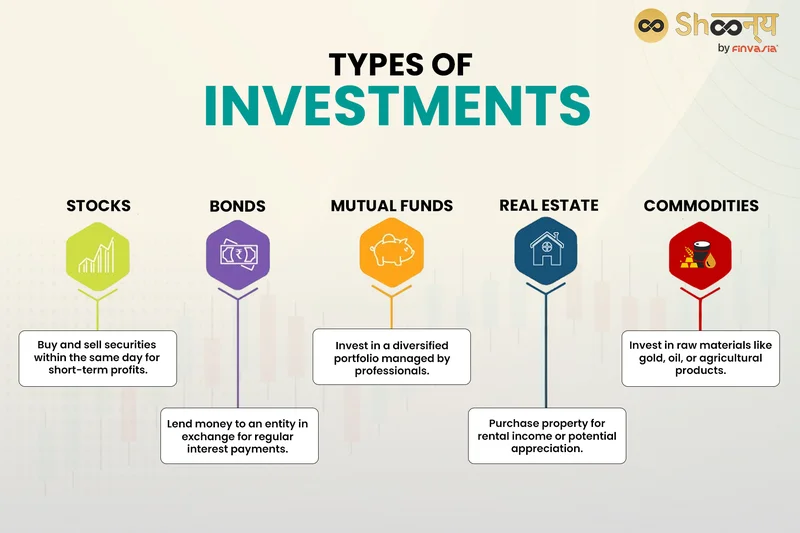

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

Nasdaq Composite: what the 'rise' really means

Wall Street's Perpetual Motion Machine: Celebrating Barely Avoiding Disaster Alright, so the governm...

Adrena: What It Is, and Why It Represents a Paradigm Shift

I spend my days looking at data, searching for the patterns that signal our future. Usually, that me...