Rigetti Computing (RGTI) Secures $5.7M Quantum Order: Dissecting the Bull Case After its 9.6% Jump

Decoding Rigetti's Quantum Leap: Is a $5.7M Sale Worth a 25% Stock Pop?

The news, when it hit the wire on October 12th, was straightforward enough. Rigetti Computing, a company navigating the treacherous and capital-intensive world of quantum hardware, secured approximately $5.7 million in purchase orders. Two of its 9-qubit Novera systems were sold—one to a U.S. laboratory, the other to an Asian technology manufacturer. In a field often defined by abstract milestones and government research grants, this was a tangible commercial victory. A product, sold for real money.

Then the market reacted. The ticker for RGTI glowed a violent green, the percentage climbing with an almost frantic energy that seemed disconnected from the sober reality of the press release. Rigetti Computing (RGTI) Is Up 9.6% After Securing $5.7M in Quantum System Orders Has The Bull Case Changed?. The stock jumped by over 25%—to be more exact, 25.02% at its peak. This is the kind of explosive move that demands a closer look. The core question for any rational observer isn't whether the sale is good news. It is. The question is one of magnitude. Does a $5.7 million order, with delivery more than a year away, fundamentally alter the company's valuation by a quarter in a single day?

Deconstructing the Dollars and Cents

Let’s first isolate the signal from the noise. The sale itself is a validation of Rigetti’s strategy. They are positioning themselves not just as researchers, but as merchants of the quantum future. Selling hardware to research-focused clients is a clear, understandable business model. It generates revenue and, more importantly, creates an ecosystem around their technology. This isn't a partnership announcement or a paper published in a journal; it's an invoice. That matters.

But context is everything. Rigetti’s path has been, and remains, financially precarious. The company has a history of sustained losses, share dilution, and a cash burn rate that makes this $5.7 million infusion look less like a war chest and more like a badly needed resupply. The systems are expected in the first half of 2026 (a significant lead time for revenue recognition), meaning this cash won’t hit the books for quite some time. The market, in its infinite and often irrational wisdom, priced in the future revenue today, ignoring the operational costs and risks between now and then.

This sale is a data point, but it’s just one. To build a trend line, you need at least two. Is this the beginning of a steady stream of commercial orders, or is it an outlier? The company’s long-term survival depends entirely on the answer to that question, and this announcement, on its own, doesn't provide it. We have a single dot on a graph where an entire curve is needed. What does this sale really tell us about the company’s ability to consistently close deals of this size? And are these customers early adopters, or do they represent a broader, sustainable market? The press release doesn't say.

The Anatomy of a Narrative Stock

This brings us to the market’s reaction, which feels less like a calculated response and more like a jolt of raw sentiment. I’ve looked at hundreds of these filings and the subsequent market moves, and this particular pattern is classic for what I’d call a "narrative-driven" asset. The actual numbers are secondary to the story they seem to tell. In this case, the story is: Quantum is finally real, and Rigetti is selling it.

This sale acts as a catalyst for a market starved for good news in the quantum sector. It’s like the first visible crack in a dam. The crack itself is small, but it implies a massive force building up behind it. Traders aren't buying $5.7 million in 2026 revenue; they’re buying the possibility that this is the start of a flood. The problem with this analogy, of course, is that sometimes a crack is just a crack.

Look no further than the community price targets for evidence of this narrative-based valuation. The fact sheet notes 43 targets with a spread from a dismal US$0.22 to an astronomical US$26. A range this wide isn't an analysis; it's a Rorschach test. It reflects a complete and utter lack of consensus on the company's fundamental value. When forecasts have a variance of over 10,000%, it tells you that nobody is using a discounted cash flow model. They are guessing. They are betting on a story. And this is the part of the data that I find genuinely baffling: the sheer range of these price targets suggests that the underlying asset is being treated more like a lottery ticket than a share of a business.

The Signal-to-Noise Ratio is Still Too Low

Let's be clear: this is a positive development for Rigetti. Securing commercial hardware orders is a critical proof point, and it distinguishes them from competitors who are still mired in the purely theoretical. It is a tangible, quantifiable achievement in a field full of hype.

But the market's 25% surge is a classic case of extrapolating a single event into a paradigm shift. The underlying financial risks facing the company have not vanished. The timeline to profitability remains an unknown variable. This $5.7 million order, while welcome, does not change the fundamental equation of high cash burn and an uncertain commercial future. It is a signal, yes, but a faint one, broadcast through a storm of speculative noise. The real test for Rigetti isn't celebrating this win. It's proving, with more data, that it can be repeated. Until then, the prudent analysis is to see this for what it is: a promising outlier, not a new trend line.

Related Articles

LendingTree's CEO is Dead: Let's Talk About the Real Fallout

The Visionary is Dead. The Press Release Was Ready. One minute, you’re a 55-year-old tech founder ri...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

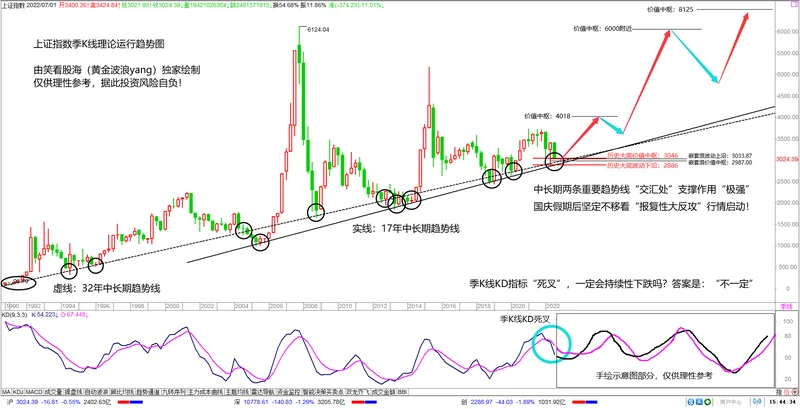

China's SSE Index Upgrade: Why This Signals a New Era for Global Tech & Finance

I spend most of my days thinking about the future. I look at breakthroughs in quantum computing, AI,...

The VIX Name is a Complete Mess: What the Streaming Service Is vs. That Stock Market Thing

So, the market’s "fear gauge" finally decided to show a pulse. Give me a break. On Friday, the VIX s...

Firo: What's the deal?

AI's Latest Hype Cycle: Are We All Just Falling for It Again? Alright, let's cut through the bullshi...

ARM Stock: Analyzing the price surge and what comes next

ARM's Surge is a Warning Sign, Not a Victory Lap On Monday, the market did what it does best: it rea...