LendingTree's CEO is Dead: Let's Talk About the Real Fallout

The Visionary is Dead. The Press Release Was Ready.

One minute, you’re a 55-year-old tech founder riding an ATV on a Sunday. The next, you’re a press release.

That’s the cold, hard math of the universe we’ve built. Doug Lebda, the guy who founded LendingTree because he was personally pissed off about how hard it was to get a mortgage, is dead. And before anyone could even process the shock of a sudden, almost mundane accident, the corporate machine he created whirred to life, spitting out perfectly crafted statements about his "relentless drive" and "passion."

The board called him a "visionary leader." His successor, Scott Peyree, dutifully noted that Lebda had put a "strong management team in place." It’s all so smooth. So clean. A man’s life ends violently on a dirt path, and the immediate, overwhelming response from the world he built is reassurance. Reassurance for whom? For his grieving family? Offcourse not. It’s for the shareholders. It’s a message beamed directly to Wall Street: Don’t panic. The org chart is updated. The stock is safe.

This is business as usual. No, "business as usual" doesn't cover the sheer, chilling efficiency of it. It’s the corporate death playbook, executed to perfection. It’s a testament to a system so well-oiled that the ghost of its own creator doesn’t even cause a hiccup. Is that the ultimate tribute to his leadership, or is it the most depressing legacy a founder could possibly leave behind?

From Annoying Problem to Corporate Myth

Let's be real for a second. We love to turn these founders into gods. We talk about their "vision" as if they descended from a mountain with stone tablets. The truth is usually far less sexy.

Doug Lebda wasn't trying to change the world. He was a consultant at PriceWaterhouseCoopers who got fed up with the soul-crushing process of shopping for a home loan in the 90s. He famously said, "All of my ideas come from my own experiences and problems." That’s it. That’s the grand origin story. He didn't see the future; he just saw a massive pain in the ass and built a website to fix it.

And it worked. Brilliantly. He turned a personal frustration into a public company, a household name. But the corporate storytellers can’t leave it at that. They have to build the myth. He becomes a "visionary" who "transformed the financial services landscape."

It’s like praising a master plumber for revolutionizing fluid dynamics. Sure, he stopped the leak, and he did it better than anyone else, but he was fundamentally a guy with a wrench solving a practical problem. Why does capitalism demand we turn every successful problem-solver into a prophet? Does it make the stock feel more valuable if we pretend its founder could see through time? It’s exhausting. It’s the same reason every startup now needs a world-changing mission statement instead of just admitting, "We sell socks, but with a better subscription model."

The real story of Doug Lebda is more interesting, and frankly, more inspiring than the PR version. It’s the story of a regular guy who refused to accept that a stupid system had to remain stupid. That’s a legacy. The rest is just marketing copy.

The Machine He Built

So what happens now? Nothing.

That’s the brutal, unvarnished truth. The new CEO is in place. The board has a new chairman. The market will digest the news, the algorithms will recalibrate, and LendingTree will continue to do exactly what it was designed to do: connect borrowers and lenders with ruthless efficiency.

The company is a machine, and a well-built machine doesn’t care who turns the key. Lebda’s greatest success wasn’t just founding the company; it was building it so thoroughly that it no longer needed him. It doesn't need a visionary or a personality. It just needs inputs and outputs. It ain't a cult of personality, it's a utility.

His wife, Megan, released a statement that felt like it was from another planet compared to the corporate eulogies. She said he "was an amazing man with a heart so big it seemed to have room for everyone he met." It’s a statement about a human being. The board’s statement was about an asset.

You can almost picture the scene. A somber, wood-paneled room where board members approve the press release, nodding gravely. They talk about honoring his memory by "continuing his work." And in a way, they are. They’re keeping the machine running, the one thing he built that was guaranteed to outlive him. They'll ring the bell on Wall Street tomorrow, and the numbers will go up or down, and everyone will move on because...

The King is Dead, Long Live the Algorithm

Here’s my final take. The real tragedy here isn’t just that a man died too young in a freak accident. The deeper, more chilling tragedy is how completely and instantly the system he created absorbed the shock and erased his necessity. The ultimate triumph of his life's work is its total indifference to his death. He built a perfect, self-perpetuating machine. And in the end, he was just another part that could be seamlessly replaced. That’s the coldest tribute of all.

Related Articles

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

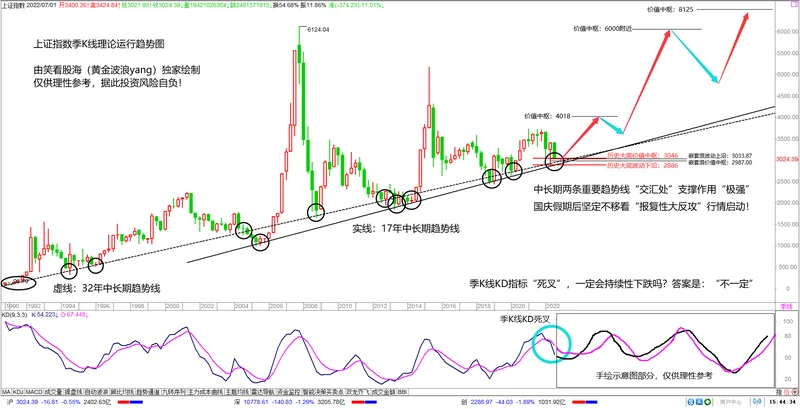

China's SSE Index Upgrade: Why This Signals a New Era for Global Tech & Finance

I spend most of my days thinking about the future. I look at breakthroughs in quantum computing, AI,...

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

Stock Market Decline: Consumer Sentiment vs. Tech Sector

Okay, let's talk about this market wobble. The headlines are screaming about a "sell-off" and "inves...

Rigetti Computing (RGTI) Secures $5.7M Quantum Order: Dissecting the Bull Case After its 9.6% Jump

Decoding Rigetti's Quantum Leap: Is a $5.7M Sale Worth a 25% Stock Pop? The news, when it hit the wi...