ABAT's Stock Surge: Separating the News from the Financial Reality

The market loves a good story, and American Battery Technology Company (NASDAQ: ABAT) just delivered a blockbuster. The announcement that it had completed the labyrinthine National Environmental Policy Act (NEPA) baseline studies for its Tonopah Flats Lithium Project sent the stock soaring. Retail investors, seeing a 23% single-day pop, piled in. The narrative is powerful: a massive domestic lithium source, crucial for national security and the EV revolution, just cleared a huge regulatory hurdle. The company’s press releases are filled with self-congratulation, and analyst sentiment is "cautiously optimistic."

But my job isn't to read the press release; it's to read the balance sheet. And when you place the operational narrative next to the financial data, a significant discrepancy emerges. The market is pricing in the completion of a marathon, but my analysis suggests the company has merely finished the first leg of an ultra-endurance triathlon. The recent surge is a reaction to a de-risking event, but it ignores the colossal execution risk that lies ahead. The question isn't whether clearing the NEPA hurdle is a milestone—it is. The real question is whether that milestone is a solid foundation or a beautifully constructed mirage.

Deconstructing the Milestone

Let's be clear: completing 21 baseline studies across 14 different categories is a monumental bureaucratic achievement. This wasn't a weekend project. This was a multi-year slog involving coordination with over 40 regulatory agencies. When CEO Ryan Melsert expresses pride in his team, it's justified. Getting this package submitted to the Bureau of Land Management (BLM) is the equivalent of a rocket passing all its pre-flight checks. Furthermore, the project's designation as a "Covered Priority Project" under a 2025 Executive Order is a powerful tailwind, theoretically expediting the path to approval.

This is the story the market bought. It's a narrative of competence, progress, and federal support.

But a permit is not a mine. This whole process is like getting the architectural blueprints for a skyscraper approved by the city. It’s an absolutely critical, expensive, and time-consuming step. Without it, nothing happens. But you haven't bought a single girder of steel, poured an ounce of concrete, or hired a single union worker. The most capital-intensive and operationally difficult part of the project—actually building the thing—is still entirely in the future. I've looked at hundreds of these filings, and this is the part of the story that I find genuinely puzzling: the market's willingness to conflate bureaucratic progress with operational certainty.

The completion of these studies proves the company can navigate a complex regulatory environment. It does not, however, prove it can profitably extract 21.15 million tons of lithium hydroxide monohydrate (a figure that itself will be scrutinized in the upcoming Pre-Feasibility Study) from the Nevada desert. How much did these 21 studies and the associated multi-year effort cost in cash burn and shareholder dilution? And more importantly, what does that figure tell us about the projected costs to get this 10,340-acre project to its first ounce of production?

The Balance Sheet Reality Check

While the operational team was busy with environmental studies, the finance department was managing a very different reality. The latest quarterly report is a study in contrasts. On one hand, the company’s liquidity position appears solid. A low debt-to-equity ratio of 0.11 and a current ratio of 2.2 suggest it can meet its short-term obligations without issue. Revenue, while small, tripled year-over-year to just over $4 million, showing some nascent commercial traction, likely from its recycling ventures.

This is where the good news ends.

On that $4 million of revenue, the company posted a net loss of $10,208,978. Let that sink in. The profit margin was negative 1090.85%. The EBIT margin was negative 1090.4%. For every dollar of revenue that came in the door, nearly eleven dollars went out to cover costs. Now, pre-revenue and early-stage growth companies are expected to burn cash. It’s the nature of the beast. But a negative margin of that magnitude is an outlier that signals an almost breathtaking cash incineration rate.

The recent stock surge was impressive, with the price climbing about 24%—to be more exact, it closed at $6.79 after an opening of $5.48, a 23.9% gain in a single period. But this rally was fueled by a narrative, not by earnings. The company did announce a new $144 million grant, which is a significant non-dilutive cash infusion. But against the backdrop of a $10 million quarterly loss, how long does that runway truly last? Is that grant, combined with their current cash, enough to bridge the chasm between now and profitable mining operations, or is it simply a lifeline before the next, inevitable equity offering?

The market is celebrating a future promise, but the present financials are screaming about the cost of that promise. The risk profile for ABAT hasn't been eliminated; it has simply shifted. Regulatory risk is now being replaced by a far more daunting specter: operational and financial execution risk.

The Narrative is Priced In. The Execution is Not.

My final analysis is this: American Battery Technology Company has flawlessly executed the first part of its plan. It has built a compelling narrative, secured a strategic asset, and navigated the brutal American regulatory process with undeniable skill. The market has rewarded this narrative, pricing the stock as if the hardest part is over.

It isn't.

The data suggests the company is entering its most perilous phase. The challenge is no longer about satisfying regulators; it's about satisfying the laws of physics and economics. It’s about building and operating a massive industrial project profitably. The current valuation reflects the story. The future valuation will depend entirely on whether that story can be converted into positive cash flow. The milestone is real, but until the company demonstrates a clear and credible path to profitability, it remains just that—a single marker on a very long and expensive road.

Related Articles

Immaculata's Open House: A Data-Driven Breakdown for Prospective Students

On the surface, the announcement is unremarkable. Immaculata University, a private institution nestl...

LendingTree's CEO is Dead: Let's Talk About the Real Fallout

The Visionary is Dead. The Press Release Was Ready. One minute, you’re a 55-year-old tech founder ri...

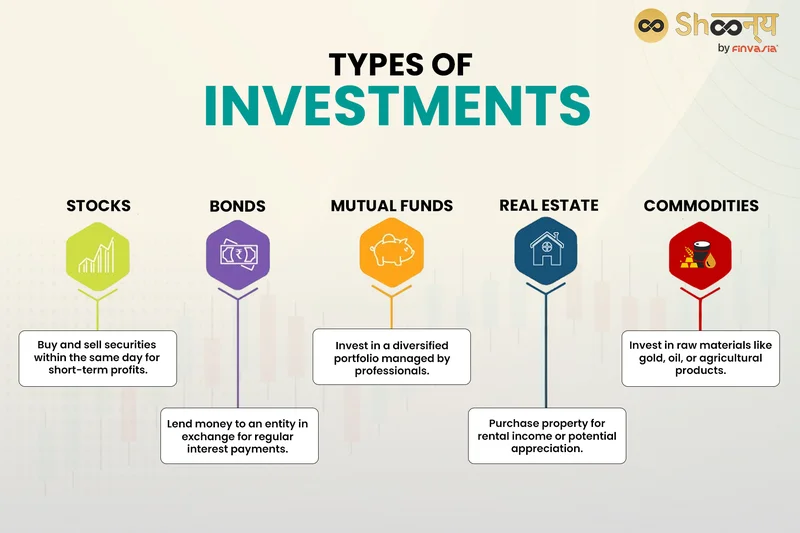

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

Funko's Future: Sales Dip vs. Pop Culture Domination – What Reddit is Saying

Funko's Not Dying, It's Evolving: Why the Pop Culture King is Poised for a Comeback Okay, let's be r...

That VTI 'What If' Article: Why It's Mostly Garbage

So, I pulled up my portfolio this morning. September 4, 2025. Ten years to the day since I dropped a...

The 'Mad Money' Phenomenon: What Our Search for Cramer & Keaton Reveals About Us

Jim Cramer Just Dismissed the Future of Work and Flight. Here's Why He's Missing the Bigger Picture....