CRM Stock: Achmea's Increased Holdings and What It Means

A Glimpse Behind the Curtain: What Salesforce's Stock Activity Really Tells Us

Achmea Investment Management B.V. upped its stake in Salesforce by 9.2% in the second quarter of 2025, bringing their total to 148,254 shares, worth just north of $40 million. That's the headline. But what does it mean? It's easy to get lost in the percentages and dollar signs, so let's break it down. According to Achmea Investment Management B.V. Increases Stock Holdings in Salesforce Inc. $CRM - MarketBeat, Achmea's increased investment reflects a growing confidence in the company's long-term prospects.

Institutional Moves and the Benioff Factor

First, consider the context. Hedge funds and institutional investors hold over 80% of Salesforce's stock. So, Achmea's move, while significant for them, is a ripple in a large pond. More interesting are the moves by smaller players: Painted Porch Advisors, Capital A Wealth Management, CBIZ Investment Advisory Services, and Christopher J. Hasenberg Inc all increased their stakes, some by substantial percentages (260%, 450%, 314.8%, and 383.3% respectively). These smaller firms might be more reactive to short-term signals, making their moves a potentially better indicator of near-term sentiment.

Then there's the insider activity. CEO Marc Benioff sold 2,250 shares in early September. While that sounds like a lot, it's a tiny fraction of his total holdings (he still owns nearly 12 million shares). A single sale doesn't necessarily signal a lack of confidence, but the timing is notable. Was this simply a personal liquidity event, or did he foresee something the rest of us didn't? (We can only speculate.) On the flip side, Director David Blair Kirk bought 3,400 shares around the same time. Conflicting signals, to say the least.

It's also worth noting that over the last 90 days, insiders have sold a total of 76,622 shares worth nearly $19 million. That's a larger trend, and one that warrants closer inspection. Is this a coordinated exit strategy, or just routine portfolio management? The data doesn't tell us, but it raises the question.

The Numbers Beneath the Surface

Salesforce's financials paint a mixed picture. The company beat EPS estimates ($2.91 versus $2.78), and revenue was up 9.8% year-over-year, landing at $10.24 billion. Not bad. But here's where I start to raise an eyebrow. Analyst ratings are generally positive ("Moderate Buy" with an average price target of $325.23), but several firms have lowered their price targets recently. UBS Group, Wells Fargo, and KeyCorp all scaled back their expectations, even while maintaining generally positive ratings.

And this is the part that I find genuinely puzzling. If the company is performing well, and analysts are still generally bullish, why the downward revisions? One possibility is that the market has already priced in much of Salesforce's future growth. Another is that analysts are hedging their bets, acknowledging potential headwinds in the broader economy. Salesforce's FY 2026 guidance is 11.330-11.370 EPS, while Q3 2026 guidance is 2.840-2.860 EPS. That's a pretty narrow range, suggesting a high degree of confidence (or perhaps a lack of imagination) in their forecasting.

The debt-to-equity ratio of 0.14 looks solid, and the current and quick ratios of 1.12 suggest healthy liquidity. But the price-to-earnings ratio of 36.75 is relatively high, indicating that investors are paying a premium for each dollar of earnings. The price-to-earnings-growth ratio of 2.11—to be more exact, 2.11—suggests that the stock might be overvalued relative to its growth prospects.

The Verdict: A Calculated Gamble

So, what's the takeaway? Salesforce is a mature company, and its stock is behaving accordingly. Institutional investors are making incremental adjustments, while smaller players are potentially more reactive to short-term news. Insider activity is mixed, but the overall trend suggests some level of profit-taking. The financials are solid, but the valuation is rich. The analyst downgrades, even with positive ratings, suggest a degree of caution.

In short, investing in Salesforce at this point is a calculated gamble. It's not a high-growth, high-risk play, but it's also not a guaranteed winner. It's a steady, reliable company with a strong market position, but its future returns may be more modest than its past performance.

The Hype Doesn't Match the Data

Related Articles

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Robinhood's Next Chapter: Decoding the 2025 Vision and What It Means for the Future of Investing

It’s easy to get lost in the numbers, and with Robinhood in 2025, the numbers are absolutely stagger...

Firo: What's the deal?

AI's Latest Hype Cycle: Are We All Just Falling for It Again? Alright, let's cut through the bullshi...

The 2025 Stimulus Check Proposal: Separating Political Claims from IRS Reality

The Ghost in the Machine: A Data-Driven Debunking of 2025 Stimulus Check Rumors The internet is a fa...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

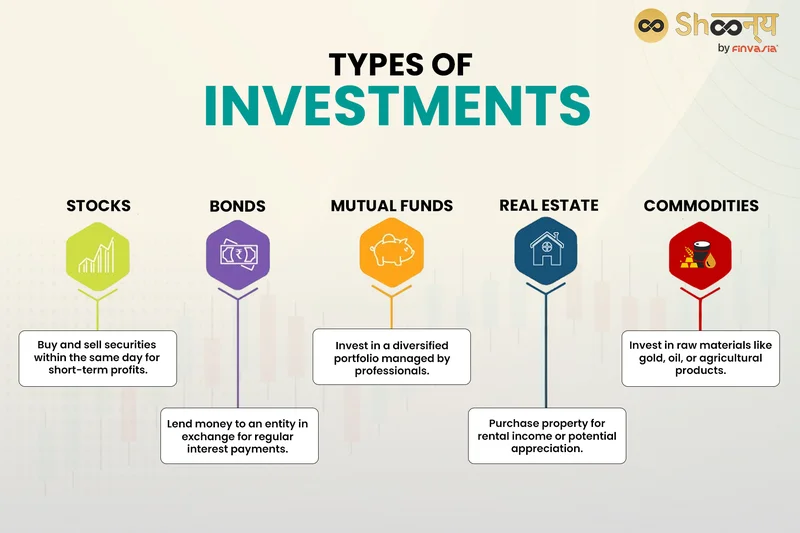

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...